The opening of the banking system has accelerated the digitalisation of the finance function by promoting the communication of banking data. Indeed, many technological innovations have been developed since then, especially in relation to Cash management.

Financial context

Thanks to an environment that favors sharing banking data, the finance function has experienced a vast digital transformation.

Indeed, the Payment Services Directive (PSD2) came into force in 2019 in the European Union.

It had 2 objectives:

- Improving the security of online transactions with stronger customer authentification;

- Opening the banking market to new payment players (except banks), i.e.Open Banking.

It is now possible to gather all the banking data of a same customer on a single platform in a secure way through an API.

What is an API?

An Application Programming Interface (API) ‘An application programming interface (API) is a way of accessing a service (such as data or functions) provided by a third-party system. In practical terms, this means enabling applications to communicate with each other.

For example, VTC applications use APIs to call on the services of third-party applications. Uber uses the geolocation service provided by the Google Maps’ API to find the driver's route.

To go further

To get into the details, APIs are divided into 3 parts. Starting with the modules, which represent the front door. They call a specific service, which in turn calls the database.

Let's take the example of a bakery. The customer will ask the cashier for a baguette. In this scenario, the cashier represents the module, the gateway to the API. She will ask the baker, the specific service, for a baguette. The baker will then ask his supplier, the database, for the necessary ingredients. The latter will give it to him, which will allow the baker, the service, to make a baguette, which he will give to the cashier, the module, who will in turn give it to the customer.

What is the role of an API in cash management software?

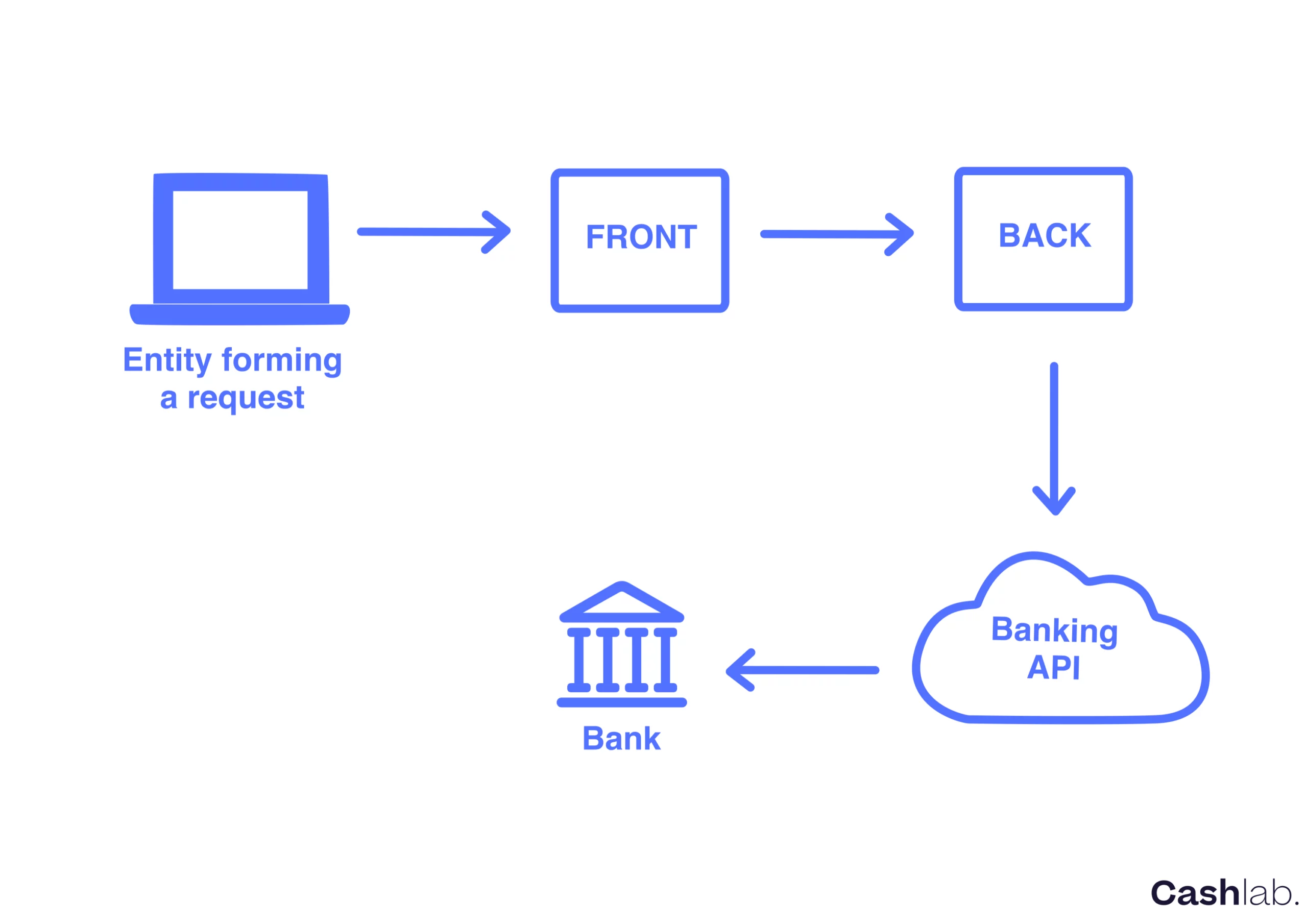

In the context of a Cash management software like Cashlab, we use a bank connection service via the API of our supplier, a bank account aggregator.

This allows our customers to connect their bank accounts to our tool in just a few clicks.

Scheme 1: When a customer makes a request on our tool, the front end will forward the call to the back end, our API, which will then call the API of our provider to retrieve the banking data of our customers.

What are the different types of API?

There are 3 different types of APIs:

- The Open APIs allow data to be communicated to third-party actors, such as vendors or customers.

- Then, the Partner APIs which are similar to open APIs with a higher level of security.

- And finally, the Internal (private) APIs which are closed to the public and used only within a company.

In addition, there are different API architectures, the most common of which is REST (Representational State Transfer). It offers technical flexibility but must meet a number of constraints.

APIs at Cashlab

At Cashlab, we use 2 types of APIs:

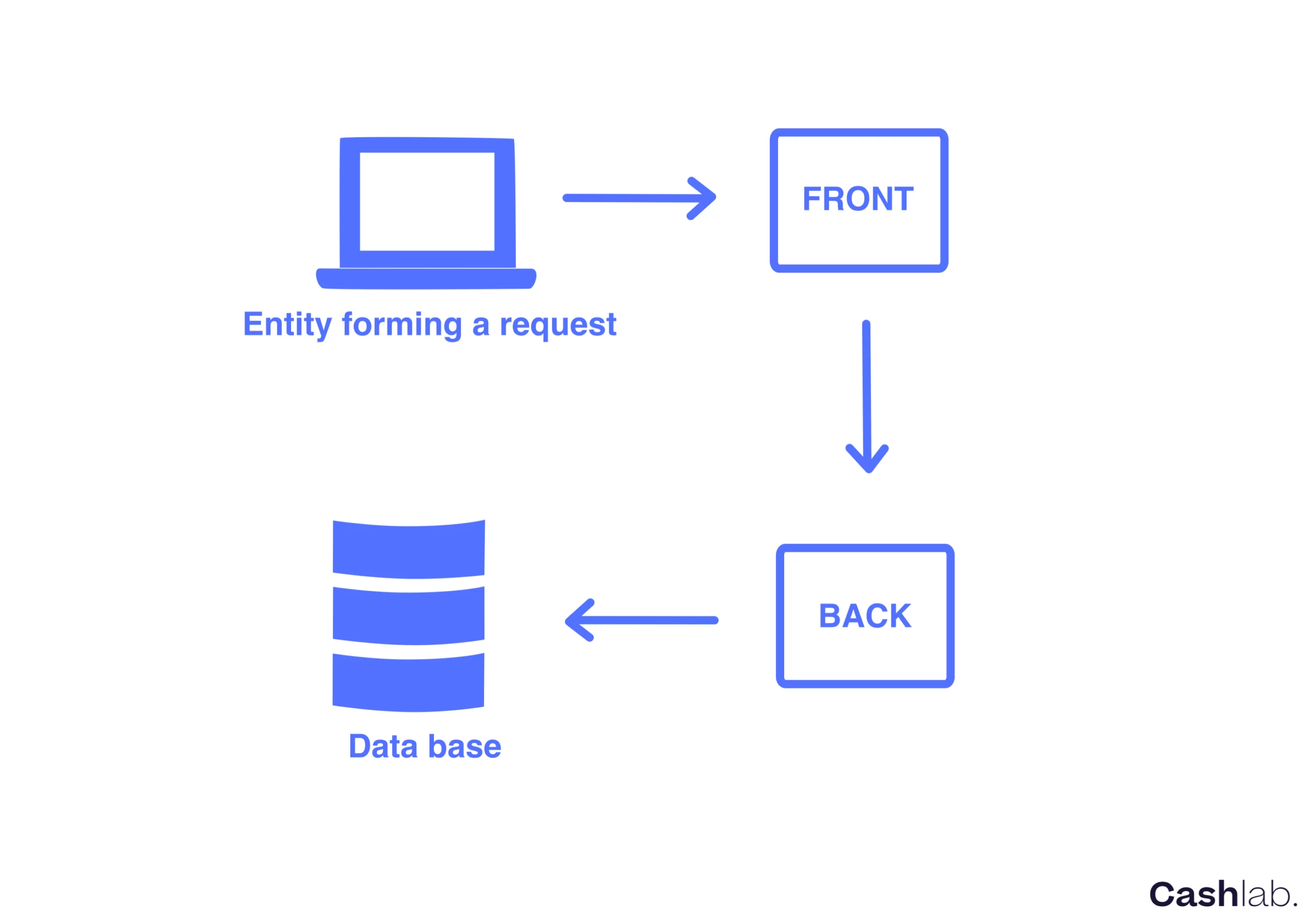

- We have developed our own API: our back end takes care of our clients' requests. For example, when they want to display their cash flow forecasts..

Scheme 2: The client makes the request, which is received by our front end, which in turn will ask the back end to output the forecast.

- An Open banking APIs with a REST architecture: to retrieve our customers' transactions and categorize them automatically, directly from their banks.

Thanks to APIs, Cashlab can integrate other solutions or connect to external tools.

For more information on our tool, please feel free to request a demo from our team by clicking here.

Ecrit par Eléonore, le 21/04/2022.

2021, Cash Management is a sustainable part of financial management

The priorities for CFOs in 2021 were unveiled at the latest DFCG Financium. The year 2020 that we have experienced has put financial indicators for cash management on the podium.

Cash management in times of crisis: the case of consulting firms

Cash management in times of crisis as seen by Paul Trévillot, CFO at Wemanity. Interview with a crisis management consulting firm.

2021: year of cash

2021, the year of cash? Why is it so? Often abandoned in favour of Ebitda, cash management is once again becoming the management tool in this crisis.

![]()

📍1, rue des Prouvaires

75001 Paris

Follow us:

©2023 All rights reserved. | Cashlab | Legal Notice