INTERVIEW with Sophie Susterac

Regional Sales Director at Factofrance

Sophie Susterac looks back on the last two years, marked by the crisis and corporate debt, and gives some insight into short-term financing needs in 2022.

What about factoring at the end of the crisis?

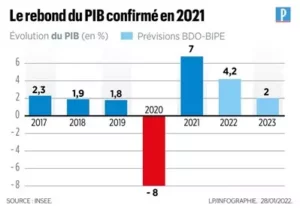

Let's take a quick look at the last two years, since the first lockdown started in France on March 17, 2020. Two particularly hectic years. As a reminder, our GDP dropped by 8% in 2020 and rebounded by 7% in 2021.

In a context of health and economic crisis, the government has put in place solutions to support the economy against the impact of the pandemic, like the State Guaranteed Loan (PGE), which allowed companies to weather the storm.

Today, as we emerge from the health crisis, the information we have at our disposal is, at first glance, a good omen.

- The economic recovery is well and truly underway. INSEE expects GDP to grow by 3% in 2022.

- The business failures have fallen sharply. There was an average of 55,000 collective procedures per year over 10 years until 2019, then 30,000 in 2020 and 28,000 in 2021.

- The average settlement times are improving. At Factofrance, we are at the forefront and we are seeing a real reduction in settlement times from 2019 to 2021. This is undoubtedly one of the beneficial effects of the State Guaranteed Loan!

- The current assessment of corporate cash flows, particularly in the industrial sector, is quite good. The balance of opinions published by both the AFTE (Association Française des Trésoriers d'Entreprise) and INSEE indicate an overall improvement in corporate cash flow. This improvement is particularly noticeable in the manufacturing industry and especially in the segment of large & mid-caps.

However!

So "everything is going very well Madame Marquise! Yes, but we have to tell you that...".

- The end of "whatever it takes" is well and truly here, signifying a return to pre-crisis situation. The 160 billion in state-guaranteed loans will have to be repaid. The possibility of deferring social security contributions is over, with some exceptions.

- A closer look at the number of company failures over a 12-month period shows that the situation is beginning to change..

- As a factor, an observatory of economic activity, one indicator is very revealing. It is the available reserve rate. What is it?

When a company mobilizes its trade receivables through a factoring contract, it has the possibility of drawing only part of the financing. There is therefore a so-called available portion that the company does not use. This available reserve increased sharply at the end of 2020 and beginning of 2021. Still the State Guaranteed Loan effect! Companies had enough cash flow and therefore had less need to use our financing.

Since Q2 2021, this available reserve has been steadily decreasing and we are getting closer to the 2019 funding level. The lowest level of this available reserve is on the micro-business side. - Balance sheets of companies that will be published soon will reveal an increase indebt, due to the State Guaranteed Loan, and an accumulation of deferred charges, and even for some a decrease in their profitability.

- Finally, the increases in supply costs currently reported in the press will have repercussions on the profitability of companies and their development. Recruitment difficulties in many sectors of activity, and particularly in the information and communication sector, will make it impossible to meet demand and thus, face the long awaited recovery. This is a sector of activity that we know well at Factofrance through our Factobail department.

All these data show that at the beginning of 2022, factoring, which is one of the leading sources of short-term financing for companies, is back on the growth track. Which is why, if by:

- securing trade receivables in this period of recovery and uncertainty,

- helping to maintain the average payment period for customers,

- and by easily freeing up sources of liquidity through the mobilization of trade receivables.

Factoring remains a particularly useful solution for many companies.

Do your customers have sufficient visibility? Are they able to quantify?

Faced with all the uncertainties described above, it is obvious that our clients lack visibility. So much so that we currently offer them factoring contracts with no minimum factoring commission and no guarantee fund limit for the coming year to cope with this lack of visibility.

On the other hand, when companies have more cash, which has been the case over the past two years, we find that executives pay less attention to their cash forecasts.

And yet it is more necessary than ever to establish cash forecasts.

Forecast PGE repayments and Ursaff moratoriums is a prerequisite. Anticipating possible difficulties by being accompanied through an amicable procedure may be the right solution in some cases.

Do your clients plan to rely on better cash management? Do they share these forecasts with you?

I don't have a global answer to this question.

For micro-businesses, the answer is mostly no. Micro-companies rarely have the ability to forecast cash flow.

In the case of MidCaps, the managers often have solutions that are more or less adapted to their Cash management But in many cases they are aware of the need to improve this management. They share their forecasts with us at our request, particularly when a contract is set up or when an existing contract is renegotiated.

Lastly, the situations of SMEs, are particularly varied. But generally speaking, I have the feeling that the cash culture is far from being implemented and that there is still a long way to go in this area. You have a lot of work ahead of you at Cashlab !

Written by Eléonore Berne, on 08/03/2022.

The 10 best tips to manage Cash according to Sabbir Rahman, former Head of Treasury for ASOS

Sabbir Rahman, former Head of Treasury for ASOS, gives us his advice on managing a company's cash.

The next challenges for the future of treasury in 2023: interview with Sabbir Rahman

Sabbir Rahman, former Head of Treasury for ASOS, explains the next 3 big challenges of treasury in 2023.

How to integrate crypto-currencies into your treasury?

Finance departments will have to deal with the use of crypto-currencies in cash flow. How to manage them?

![]()

📍1, rue des Prouvaires

75001 Paris

Follow us:

©2023 All rights reserved. | Cashlab | Legal Notice